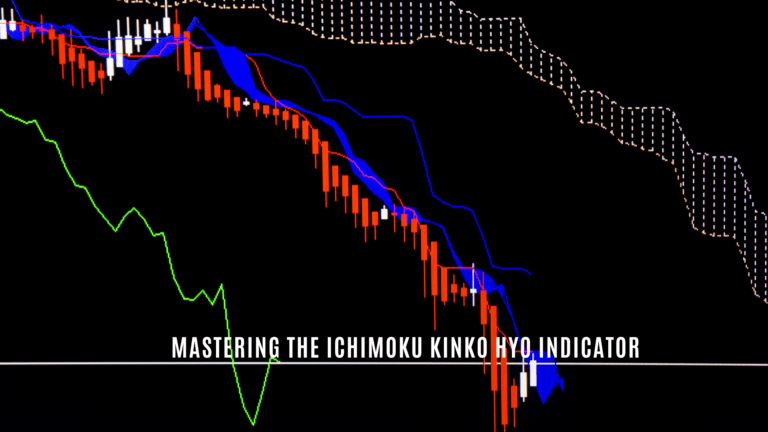

Forex Trading Strategies and Market Analysis

Stay ahead of the Currency Trading Curve with insight into our FX Strategies, Candlestick Analysis, Innovative Forex Analysis, and FX Trading Price Action Solutions. Discover our Algorithmic-Driven Currency Forecasts, Technical Analysis, Trading Pattern Approach, and Ways to Expertly Trade the US Dollar in the Foreign Exchange Market.

Bitcoin (BTCUSD) Cryptocurrency Trading Report | Technical Analysis | Updated for 1.4.2024

Based on the latest Cryptocurrency market data, this Bitcoin analysis aims to supply daily insight into the trading performance of the Bitcoin (BTCUSD) Cryptocurrency pair as of January 4, 2024. It covers daily, weekly, and monthly movement changes, the weekly correlation with the FGC Cryptocurrency Indicator (our Proprietary Cryptocurrency Indicator),

Subscribe Now

To Learn More About Our Other Products and Services.

Cryptocurrency

Bitcoin

$64,140.80

BTC -3.90%

Ethereum

$3,147.08

ETH -3.39%

NEO

$18.10

NEO -2.07%

Waves

$2.41

WAVES -8.95%

Solana

$146.71

SOL -7.18%

Tether

$1.00

USDT -0.03%

BUSD

$0.98

BUSD -0.03%

Binance Coin

$606.17

BNB 0.05%

Shiba Inu

$0.0000

SHIB -8.18%

TRON

$0.11

TRX 0.43%

Dogecoin

$0.15

DOGE -7.11%